When it comes to the security of your customers’ data, don’t just roll the dice and hope for the best. PCI Compliance is your table stake! As a merchant who does business in a digital world, it is your responsibility to ensure that your house is secure.

What Is PCI Compliance?

PCI compliance stands for Payment Card Industry Data Security Standard (PCI DSS). It’s a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure PayTech environment. These standards are established by the Payment Card Industry Security Standards Council (PCI SSC), which includes major credit card companies like Visa, MasterCard, American Express and Discover.

Why Is PCI Compliance Important for SMB Merchants?

For the small to mid-sized merchant, complying with PCI standards is not just a best practice; it’s mandated by the card brands and the PCI SSC. In fact, some states have incorporated the standards into State laws. Failing to comply can result in hefty fines, liabilities, damage to your reputation, and, in extreme cases, the loss of the ability to process credit card payments altogether.

Moreover, ensuring the security of customer data helps build trust and confidence with your customers. Today’s market is competitive and saturated with so called “experts.” Partnering with someone who has real experience and who you can trust to help navigate this crucial security component will translate through to your customers. Because their information is safe, they will trust you with their business.

Understanding the Basics of PCI Compliance

- Assessments: Small to mid-sized merchants must undergo regular assessments to ensure PCI compliance. These assessments typically involve evaluating the security measures you and your credit card provider have put in place to protect cardholder data. Some examples are encryption, access controls, and network security.

- Security Measures: Implementing effective security measures is a fundamental aspect of PCI compliance. You should protect your customers’ data as if it were your own by maintaining secure networks, implementing strong access control measures, regularly monitoring and testing networks, and maintaining information security policies.

- Compliance Validation: Depending on the volume of transactions processed, SMB merchants may need to complete a Self-Assessment Questionnaire (SAQ) or undergo a formal audit by a Qualified Security Assessor (QSA). The level of validation required is determined by the merchant’s payment card transaction volume. If your credit card payment provider is truly knowledgeable, they can help you quickly determine which assessment is right for you and save you valuable time and money that you can pour back into your business.

- Continuous Compliance: Achieving PCI compliance is not a one-time event but an ongoing process. Small to mid-sized merchants must continuously monitor and update their security measures to address evolving threats and vulnerabilities. PayTech specialty partners who provide full-service scheduling to keep you on track will not only help you avoid pricey non-compliance fees, but they will also take the burden of remembering compliance deadlines off of your shoulders.

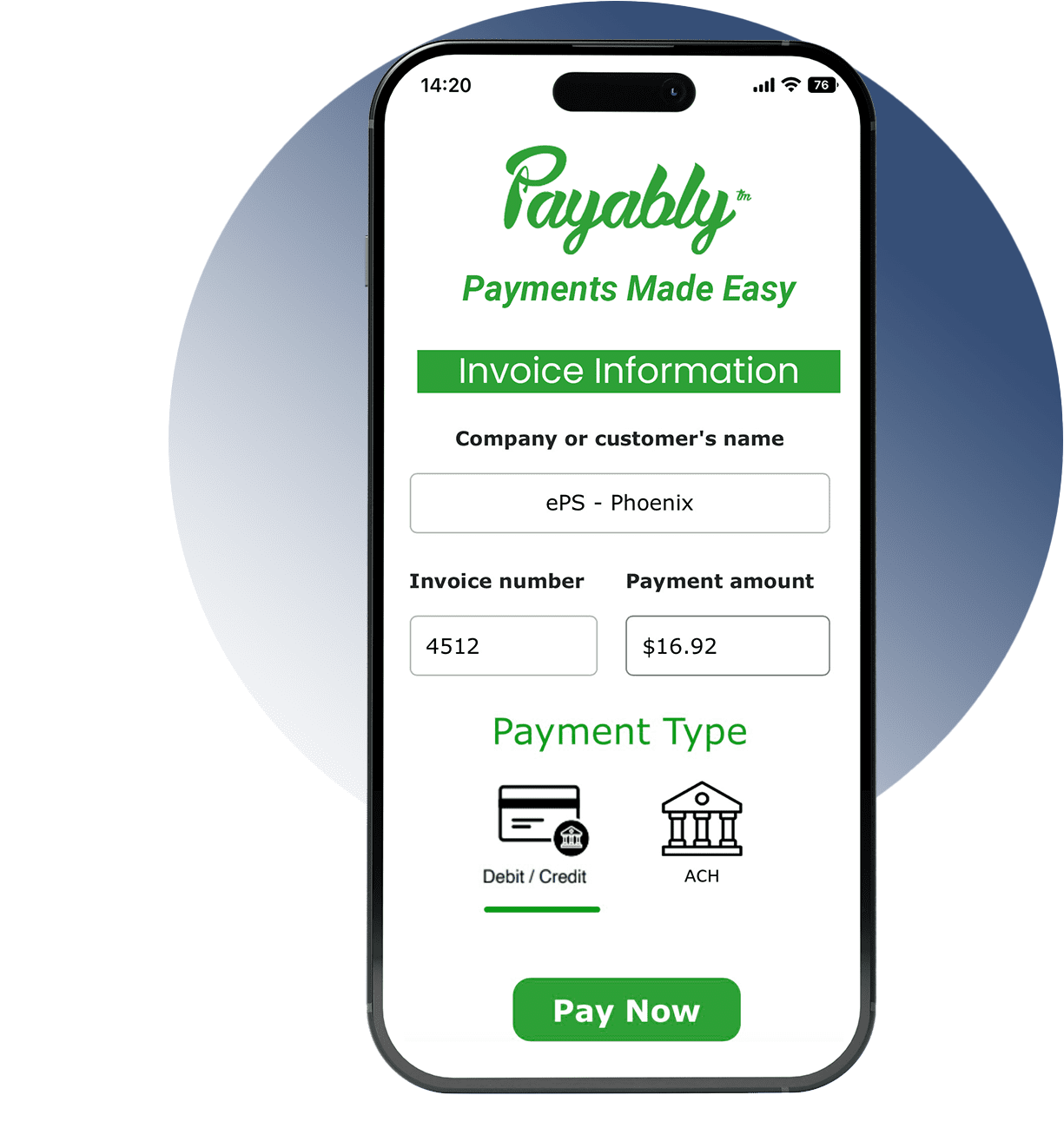

- Partnering with PCI Compliant Service Providers: SMB merchants should work with service providers that are PCI compliant themselves. This includes payment processors, web hosting providers, and any other third-party vendors that handle cardholder data. Let their experience and expertise save you time and money, so you can focus on growing your business.

Security and Compliance are not just lucky hands you are dealt. There is a strategy behind maintaining a secure environment for both you and the customers you provide services for.

PCI compliance is a critical component of any small to mid-sized business. By understanding and keeping up PCI standards or partnering with a trusted PayTech provider who will assist you with this, SMB merchants can protect customer data, avoid potential penalties, and build trust and their customer base. While achieving compliance may seem demanding in terms of time and resources, it does not have to be. Safeguarding both your business and your customers against cyber threats is priceless. Does your service provider provide a full-service, boutique PCI Compliance protection program?