The end of the month is a busy time for many business owners in America. From managing customers orders to wrapping up customer’s projects, print shop owners also have to deal with their finances. On top of the day-to-day operations, finances sometimes become overlooked. Finances doesn’t just focus on paying for equipment, utilities, and payroll, it also means balancing your books. Credit card reconciliations are an essential part of your business as it ensures that sales recorded in your books align correctly with the transactions processed by your payment processor. Yet, for many print shop owners, the process is tangled with complexities. Business owners and bookkeepers can simplify this process with actionable tips, and leverage technology like Payably for PrintSmith to make the task a breeze.

The Importance of Credit Card Reconciliation in Small Businesses

Credit card reconciliation is the process of matching transactions recorded in your books with those reported by your payment processor and bank. From invoicing regular clients for large-scale orders to processing quick payments for walk-in customers, keeping track of every swipe, tap, or key-in can be daunting.

You may have recurring charges for design software subscriptions, equipment leases, or suppliers that you charge to a credit card. Then there’s the stream of incoming payments from customers—often made via credit cards. Discrepancies between what you’ve billed, received, and spent can create a tangled web of confusion. Over time, unresolved mismatches can snowball, wreaking havoc on your cash flow and financial statements.

Reconciliation involves comparing the payments recorded in your business’s accounting system with the transaction details provided by your credit card processor. Spotting inconsistencies early can save you from overcharges, missed income, or processing fees.

While the process may seem tedious, mastering it isn’t impossible. With a systematic approach, you can take control of your finances and maintain a clear picture of your business’s health.

Tips to Simplify Credit Card Reconciliation

- Reconcile Daily or Weekly

Don’t wait until the end of the month to review transactions as it can increase the risk of missing discrepancies. Set aside a dedicated time—either daily or weekly—to review transactions. This way, you catch issues early and avoid a massive workload later. - Categorize Transactions Properly

Mislabeling transactions is one of the primary causes of reconciliation headaches. Create consistent categories for expenses and income streams—software subscriptions, paper supplies, client payments, etc. When every transaction has a clear label, matching them to statements becomes a breeze. - Automate Whenever Possible

Manual data entry is not only time-consuming but also prone to human error. Opt for software or integrations that automatically sync transaction data between your payment processor and accounting tools. - Review Fees and Adjustments

Credit card processing fees, chargebacks, and refunds can easily be overlooked. Carefully examine statements to ensure fees are correctly applied and adjustments accurately reflect your records. - Stay Organized

Use tools like spreadsheets or dedicated accounting software to keep track of transactions. Ensure invoices, receipts, and credit card statements are filed systematically for quick reference during reconciliation. - Investigate Discrepancies Promptly

If numbers don’t add up, act swiftly. Delaying investigation can make it harder to trace the root cause. Often, small issues such as duplicate transactions or misapplied fees can explain mismatches.

How Payably Can Revolutionize Help With Reconciliation

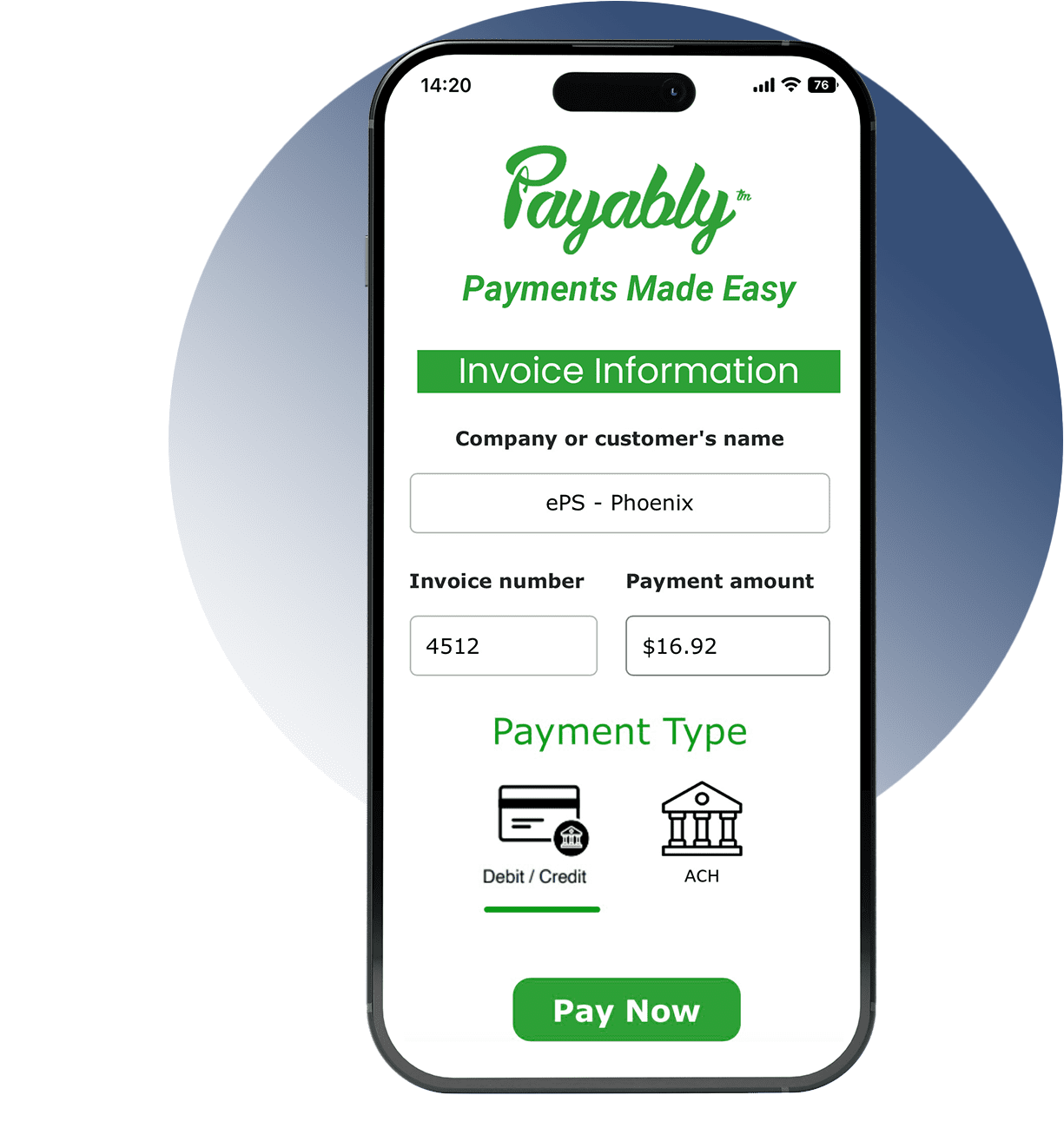

Technology has revolutionized how small businesses manage their finances, and Payably is a prime example of a tool designed with print shops in mind. This plugin offers a streamlined approach to managing credit card payments and reconciling them with your accounts. Here’s how it can make a difference:

- Works with PrintSmith

Payably has a plugin that integrates directly with PrintSmith.This means that every credit card transaction is automatically posted on PrintSmith. This eliminates the need for manual data entry and significantly reduces the risk of errors. - Real-Time Syncing

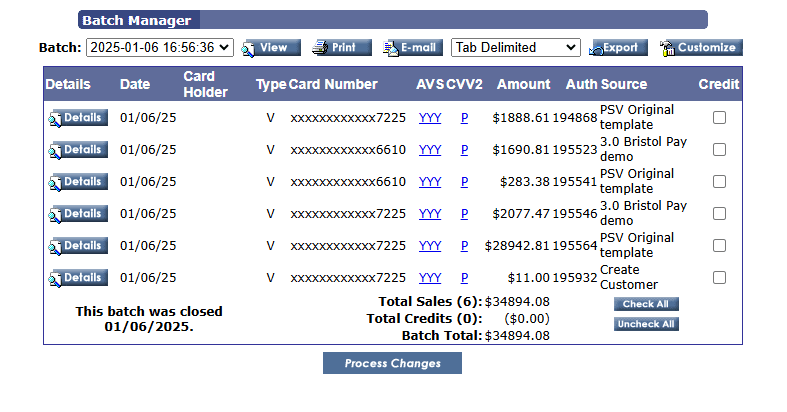

With Payably, you gain real-time visibility into your credit card transactions. This allows you to monitor payments as they happen and immediately identify discrepancies or unusual activity.s. - Detailed Reporting

Generating financial reports has never been easier. Payably’s reporting tools allow you to pull detailed records of all transactions, categorized and organized for easy review. This simplifies monthly reconciliations and prepares you for tax season. - Support Tailored to Print Shops

Unlike generic payment solutions, Payably understands the unique challenges faced by print shop owners. Whether it’s handling recurring orders or managing customer-specific pricing, Payably offers features that fit seamlessly into your workflow. - Simplified Refunds and Chargebacks

Handling refunds and chargebacks can be complex. Payably’s tools make it easier to track and reconcile these adjustments, giving you a clearer picture of your financial health.

Conclusion

Credit card reconciliation may not be the most glamorous part of running a print shop, but it’s undeniably one of the most important. By adopting best practices and leveraging technology, you can transform this tedious task into a manageable, even effortless, part of your routine. The result? A clear financial picture, more time to focus on growing your business, and the confidence that your accounts are in perfect alignment.

Take control of your finances today. Your business’s future will thank you.