To Our Valued Merchants

At Payably, we’ve always believed that the best solutions are born from listening to the needs of the print owners.

Designed specifically for small-to-medium sized businesses, our pricing is made so you can maximize your profits. Start accepting credit cards payments without the burden of worrying about outstanding fees.

Unlock profitability by leveraging our PayTech solution to propel your business forward. You get 100% direct passthrough of all interchange fees plus $0.25 per transaction when you use us as your Credit Card Processor.

No hidden markups or surprise fees when you use our payment processing.

Join the Bristol Pay members and take advantage of the flat-monthly pricing.

Lower your effective rate with our pricing structure. We review your merchant statement with you.

For businesses seeking to streamline their credit card processing operations and lower their fees, we offer a solution designed to meet your needs across various industries. By creating a credit card merchant account with us, you can can access a suite of features and services tailored to enhance efficiency, security, and flexibility in processing credit card transactions.

In retail, credit card processing happens through a Point-of-Sale (POS) terminal or an EMV-compliant smart terminal. These terminals are physically present so you can accept credit cards as a form of payment. Retail credit card processing involves swiping or inserting the card into the terminal and entering a Personal Identification Number (PIN) or signing a receipt for authorization. Retail credit card processing often incurs lower transaction fees compared to other categories, given the lower risk associated with face-to-face transactions and the presence of physical card authentication.

Mail Order/Telephone Order (MOTO) businesses– which includes online order – require a distinct approach to credit card processing. MOTO transactions are considered Card-Not-Present (CNP) transactions, which inherently carry higher risks of fraud and higher processing rates. By implementing additional authentication measures, such as Address Verification Service (AVS) and Card Verification Value (CVV) checks, we are able to lower your processing rates.

eCommerce has changed the way businesses conduct transactions, offering unparalleled convenience and accessibility to consumers worldwide. Our pricing for eCommerce Credit Card Merchant account is a Flat 2.85% + $0.25 per transaction / per MID.

At Payably, we’ve always believed that the best solutions are born from listening to the needs of the print owners.

At Payably, we’ve always believed that the best solutions are born from listening to the needs of the print owners.

Redefining the Future of Payment and Print-on-Demand View the Press Release Babylon, NY –We’re beyond thrilled to announce the acquisition...

Explore our full list of features specifically designed for you.

You'll know exactly what you're paying every month. One-flat fee, no hidden charges.

Smooth and hassle-free setup to your existing MIS when you use Payably.

We'll design Payably to fit your brand and optimize customer experience.

All of Payably's software is set up for lower interchange rates to maximize savings.

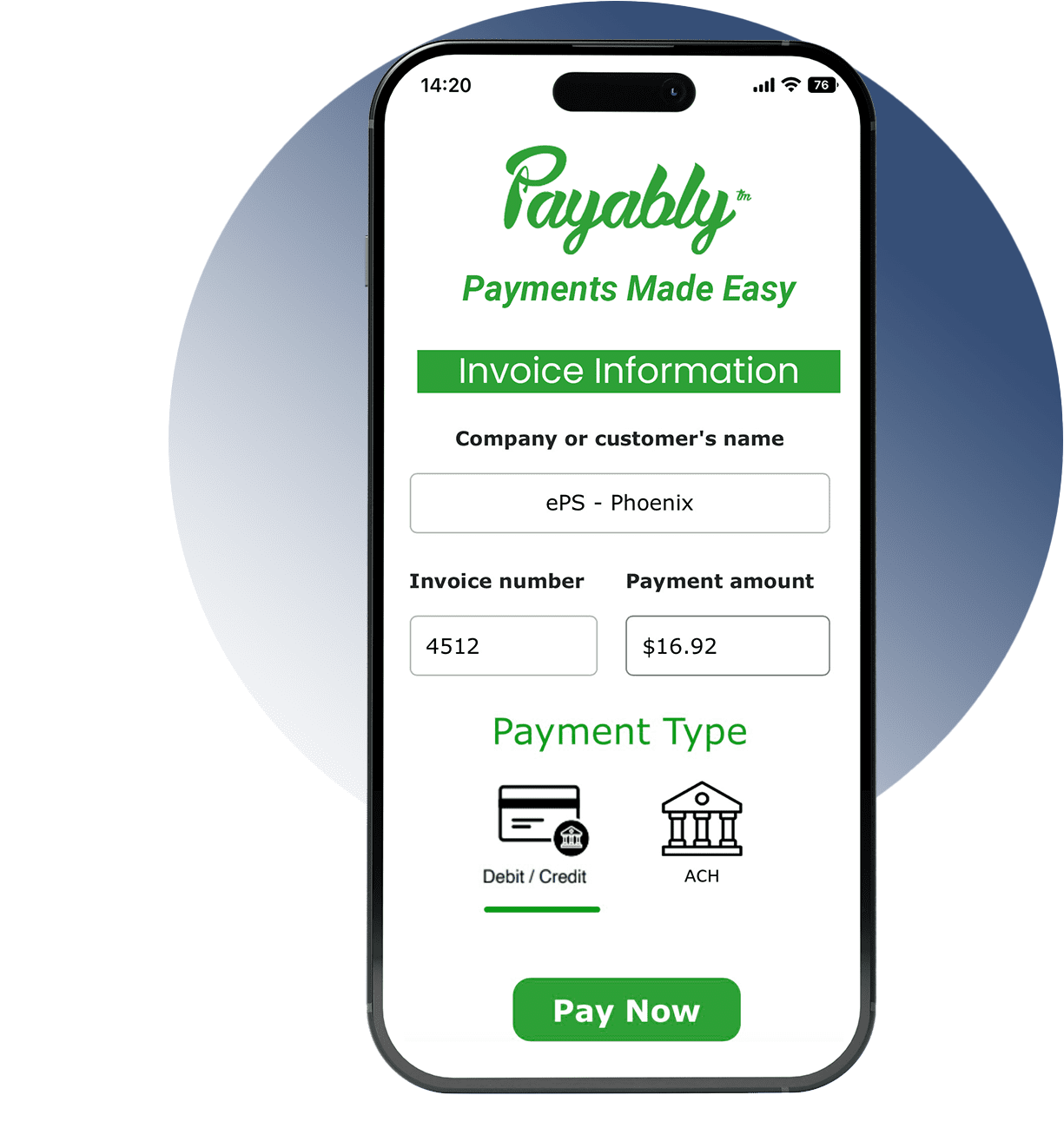

Using Payably, you can accept payments online, in-store, or over the phone.

You can securely set up automatic payments for recurring customers.

We provide hands on training to get you set up without disrupting your current services.

Every payment is tokenized to keep your customer data and transactions secure.

Our dedicated customer care team is with you every step of the way.

Join the thousands of businesses that love using Payably

Dedicated to driving business growth. Our groundbreaking technology transforms financial and operational processes.

Take payments on your PrintSmith register

Automatically post when invoices are paid

Get paid from anywhere and auto-sync data

Get paid faster with a dedicated page

Accept payments in store or remotely

Handheld POS terminal with printer

Switch and save on processing fees

Receive payments from bank accounts

Manage all payments in one place

Copyright ©

Provide a few details below and a member of our team will be in touch as quickly as possible.

Provide a few details below and a member of our team will be in touch as quickly as possible.