Welcome to the world of modern shopping, where plastic reigns supreme.

Welcome to the world of modern shopping, where plastic reigns supreme and transactions happen in the blink of an eye. Have you ever wondered about the behind the scenes that allows you to accept your credit card payments? Let’s explore what is a Credit Card Merchant Account – the unsung hero of smooth transactions. Let’s dive into what exactly this mystical entity is all about.

** Remember Merchant means YOU – the business owner**

Here’s a quick preview of what we’ll be discussing:

- The Merchant, Payment Processor, and Bank

- Defining the Retail Credit Card Merchant Account

- What is the Credit Card Transaction Process

- PCI DSS 4.0 Security Measures

- How Interchange Fees Vary

- Why Is A Smart Terminal Helpful

- Merchant Agreements

Defining the Retail Credit Card Merchant Account

At its core, a retail credit card merchant account serves as a gateway that enables businesses to accept credit card payments from customers. It acts as a liaison between the merchant, the customer, and the financial institutions involved in processing the transaction. In essence, it is a contractual agreement between the merchant and an acquiring bank or payment processor that facilitates the authorization, processing, and settlement of credit card transactions.

In simple terms, a Retail Credit Card Merchant Account is like a backstage pass for businesses to accept credit card payments. It’s an agreement between the store and a financial institution or a payment processor that lets them process those swipes and taps customers make with their trusty card.

The Merchant, Payment Processor, and Bank

Understanding the dynamics of a retail credit card merchant account involves familiarizing oneself with the key players involved. These include the merchant (you, the small business owner), who operates the business and seeks to accept credit card payments, the payment processor (Bristol Pay), which provides the merchant with the necessary infrastructure and services to process credit card transactions, and the card associations (such as Visa, Mastercard, etc.), which set the rules and regulations governing credit card transactions.

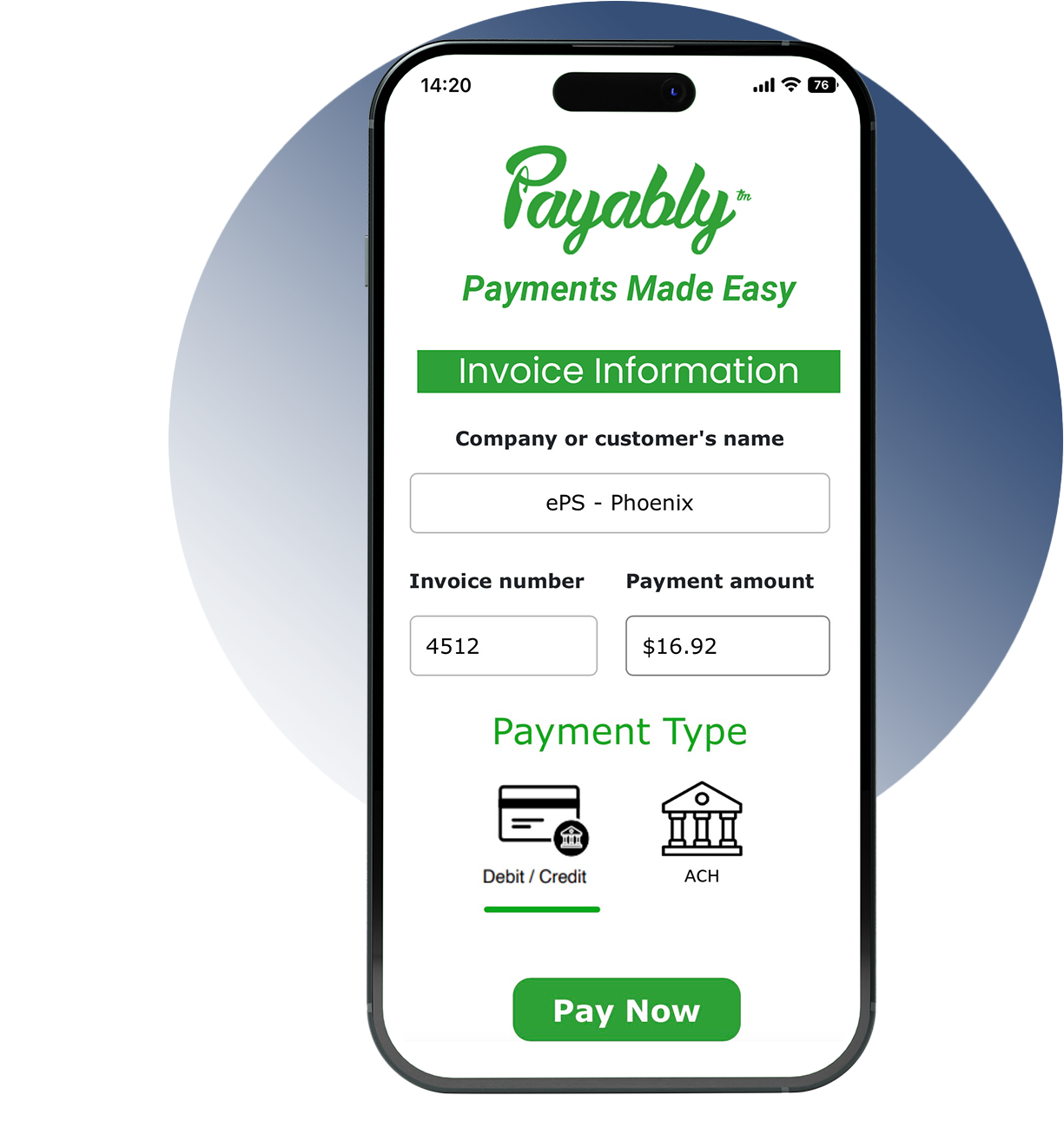

Think of us as the gatekeepers for your transactions. We provide the tools and technology that let you connect with the credit card networks and make sure everything runs smoothly.

What is the Credit Card Transaction Process

The lifecycle of a credit card transaction within a retail credit card merchant account follows a well-defined process. It begins with authorization, where the merchant seeks approval from the cardholder’s issuing bank to proceed with the transaction. Upon authorization, the transaction moves to the processing stage, where the merchant submits the transaction data to the acquiring bank or payment processor for settlement. Finally, settlement occurs, where funds are transferred from the issuing bank (customer’s bank) to the acquiring bank (your bank), completing the transaction.

Have you ever wondered how a customer’s credit card info travels from your store to the bank and back? That’s where the payment gateway comes in. It’s like a secure tunnel that encrypts your data and ensures it gets where it needs to go safely.

PCI DSS 4.0 Security Measures

Security is paramount in the realm of retail credit card merchant accounts, given the sensitive nature of payment information involved. Merchants must adhere to stringent security standards, such as Payment Card Industry Data Security Standard (PCI DSS) compliance, to safeguard customer data and prevent unauthorized access or breaches. Encryption technologies, tokenization, and fraud detection mechanisms further bolster security measures to protect against fraudulent activities.

How Interchange Fees Vary

Operating a retail credit card merchant account entails various fees and charges, which can impact the merchant’s bottom line. These may include interchange fees, which are fees paid to the cardholder’s issuing bank, assessment fees levied by card associations, and processing fees charged by the acquiring bank or payment processor. Understanding the fee structure and negotiating favorable terms can help merchants optimize their cost of accepting credit card payments.

In regards to the Retail Credit Card Merchant Account, the interchange fees are typically lower for merchants with brick-and-motor stores, because usually cards are present in those stores. Interchange fees are paid to the cardholder’s bank to cover the costs associated with the risk of approving the payment and are set by the credit card networks. Things that may affect interchange fees is how you accept payments – such as accepting a physical card in store or accepting credit card over the phone – your Merchant Category Code (MCC), and much more. It’s important to speak with us so we can provide you with the best tools in order for you to lower your rates.

Why Is A Smart Terminal Helpful

Many retail credit card merchant accounts integrate seamlessly with a Smart Terminal or Point-of-Sale (POS) systems, allowing merchants to streamline the payment process and enhance operational efficiency. POS systems enable merchants to accept credit card payments in-store, track sales data, manage inventory, and generate reports for informed decision-making. Integration with POS systems facilitates a seamless and cohesive experience for both merchants and customers.

Merchant Agreements

Navigating the regulatory landscape is essential for merchants operating retail credit card merchant accounts. Compliance with regulations such as the Fair Credit Billing Act (FCBA), Truth in Lending Act (TILA), and Electronic Fund Transfer Act (EFTA) ensures transparency, fairness, and consumer protection in credit card transactions. Merchants must stay abreast of regulatory changes and uphold compliance to avoid penalties and legal repercussions.

Along with the compliance is the merchant agreement, which is a rulebook that both the store and the bank agree to play by. It lays out things like fees, responsibilities, and other nitty-gritty details so everyone’s on the same page.

There you have it – the lowdown on Retail Credit Card Merchant Accounts. They may seem like just another cog in the machine, but they’re the glue that holds our modern transactional world together.